Financial Planning that Gives You Confidence

What if I said: ‘Congratulations, you’re going to have $1 Million when you retire!’

Your first thought might be, ‘Really?! That’s great!’

A moment later … ‘Wait, what does that mean? Will that be enough?!’

In the old days, financial planning was merely about calculating how much money you could accumulate during your working career. But we humans don’t think like that. We think in terms of what we want to do in retirement and then figure out how much monthly income we need to do it.

Goals Based Financial Planning

Financial planning should be about figuring out what you want to do in retirement, how much that’s going to cost (in today’s dollars) and figuring out how likely that is based on how much you’ve saved and how much you are saving.

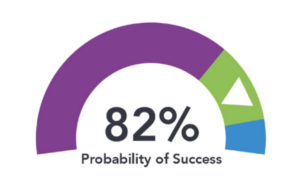

When you do financial planning that’s goals based, you get results that are based on what you said you want. The results take into account your current savings, savings rate, inflation, market growth etc. An example could be that based upon all of that, you have an 82% chance to be successful.

For you, maybe that’s good, maybe it’s not good enough. With goals based financial planning, if it’s not good enough, you can make changes that will improve your probability. Changes like saving more, working longer, having a different expectation for what you want your retirement income to be etc.

Financial planning isn’t magic, it doesn’t create wealth. Financial planning, when done right, will help you have realistic expectations about your retirement income and will give you confidence that you are on-track; And if you don’t like the results, will help you figure out what changes you can make.

Want to learn more?

Click here to schedule a meeting with us: https://www.oakroadwealth.com/contact/